Super Micro Computer Inc. (SMCI) has been a hot topic in the stock market due to its rapid growth and increasing investor interest. One crucial metric that traders and analysts track is short interest, which reflects the number of shares sold short but not yet covered or closed out. Understanding SMCI short interest can provide insights into market sentiment, potential volatility, and future stock price movements.

In this article, we will explore everything about SMCI short interest, including how it works, recent trends, implications for investors, and expert insights.

What Is Short Interest?

Short interest refers to the total number of shares that have been sold short but not yet repurchased or covered. It is usually expressed as a percentage of the total outstanding shares. A high short interest indicates that many investors are betting on the stock’s decline, while a low short interest suggests a more bullish sentiment.

Key Metrics Related to Short Interest:

- Short Interest Ratio (SIR): The number of shorted shares divided by the average daily trading volume.

- Days to Cover: The time required to buy back all shorted shares based on average daily volume.

- Short Interest as a Percentage of Float: The proportion of shares available for trading that have been shorted.

Why Does SMCI Short Interest Matter?

SMCI’s stock has seen significant growth, making it a target for both long-term investors and short sellers. Tracking SMCI short interest is essential because:

- It indicates market sentiment: High short interest might suggest bearish expectations.

- It affects stock volatility: Stocks with high short interest are more prone to short squeezes.

- It helps in risk assessment: Investors use short interest data to gauge potential downside risk.

SMCI Short Interest Trends and Analysis

Historical Trends

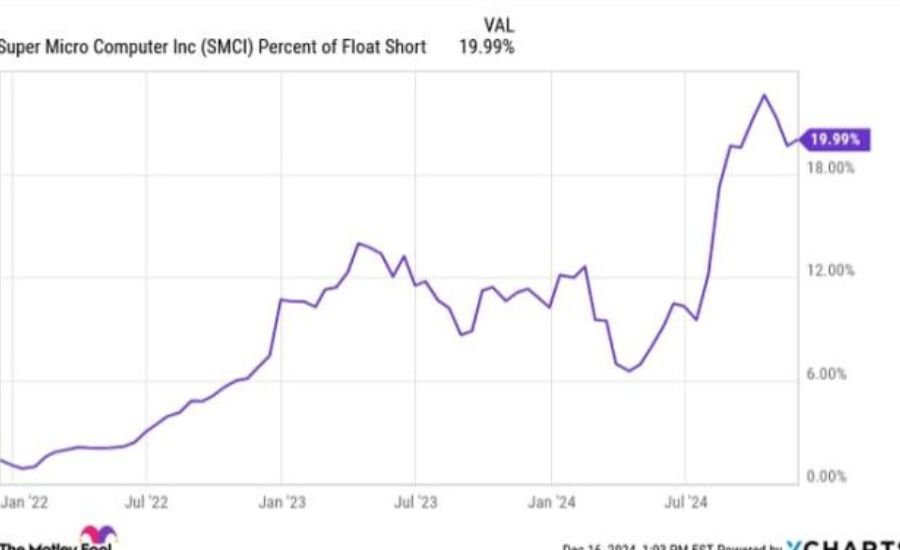

Over the past year, SMCI short interest has fluctuated as the company has gained attention in the AI and data center markets. Here are some key trends:

- Q1 2023: Short interest was relatively low as SMCI started gaining traction in the AI space.

- Q2 2023: Increased short selling due to concerns about overvaluation.

- Q3 2023: A sharp decline in short interest as the company reported strong earnings.

- Q4 2023 – Present: Short interest remains volatile, reflecting mixed market sentiment.

Recent Short Interest Data

As of the latest reporting period, SMCI’s short interest stands at X% of total outstanding shares, with a short interest ratio of Y days. This suggests that a significant number of traders are betting against the stock, but potential catalysts could trigger a short squeeze.

What Factors Influence SMCI Short Interest?

1. Company Performance and Earnings Reports

Strong financial results can reduce short interest as investors gain confidence in the stock. Conversely, disappointing earnings can lead to increased short selling.

2. Industry Trends and Market Conditions

SMCI operates in the high-growth AI, cloud computing, and server industries. Positive industry trends can discourage short sellers, while market downturns might increase short interest.

3. Macroeconomic Factors

Inflation, interest rate changes, and economic uncertainty can impact short interest levels. A weak economy might lead to higher short selling activity.

4. Institutional Investor Activity

Large institutional investors play a crucial role in influencing short interest. If major hedge funds increase their short positions, it could drive up short interest.

The Risk of a Short Squeeze in SMCI

What is a Short Squeeze?

A short squeeze occurs when a heavily shorted stock suddenly rises, forcing short sellers to cover their positions, which drives the price even higher. Stocks with high short interest and low float are more susceptible to short squeezes.

Could SMCI Experience a Short Squeeze?

Given its current short interest percentage and trading volume, SMCI has the potential for a short squeeze, especially if:

- A positive earnings report surprises the market.

- Institutional investors increase their long positions.

- Retail investors coordinate a buying surge.

Read Next: Thebutterflylocs

How to Use Short Interest Data for SMCI Trading Strategies

1. Long-Term Investors

For those holding SMCI for the long run, short interest data can help assess whether a stock is under pressure from short sellers and whether a potential squeeze could boost prices.

2. Swing Traders

Swing traders can use SMCI short interest trends to time their trades, capitalizing on sudden price movements driven by covering activity.

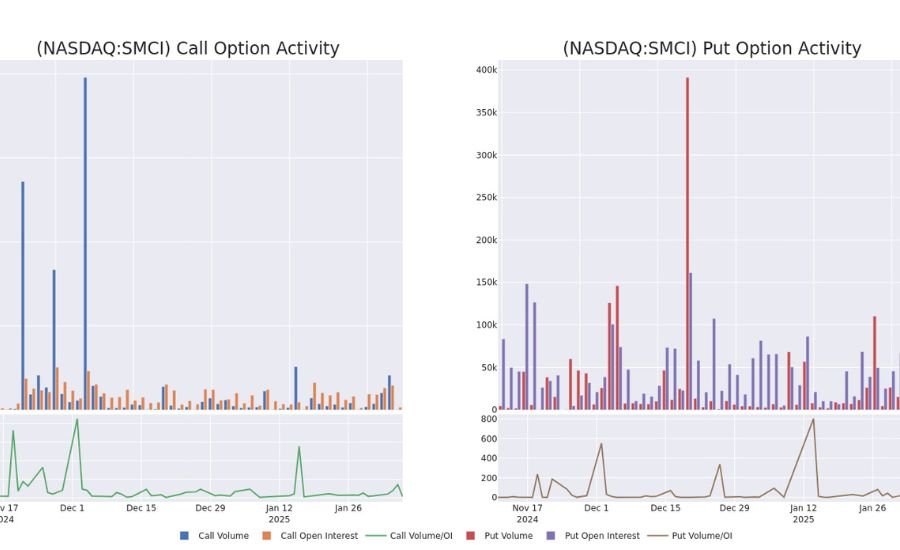

3. Options Traders

Options traders monitor short interest to identify high-risk, high-reward opportunities. High short interest can lead to increased volatility, making options strategies more attractive.

Expert Predictions on SMCI Stock and Short Interest

1. Analysts’ Outlook

- Bullish View: Some analysts predict continued growth for SMCI due to its strong positioning in AI and server technology.

- Bearish View: Others warn that the stock’s valuation may be overstretched, leading to potential pullbacks.

2. Institutional Investor Moves

Tracking hedge funds and institutional investors can provide insights into future short interest trends.

Conclusion

SMCI short interest is something every investor should watch. If a lot of people are betting against the stock, prices could go up and down very fast. Some traders might try to make money from this, but others might be worried about risks. Watching short interest helps investors make smart choices.

If SMCI keeps growing and does well in the AI market, short sellers might lose their bets. But if the stock faces problems, short interest could go up again. Always stay informed, check market trends, and be ready for any surprises!

Don’t Miss Out: Cryptoweeksbloomberg

FAQs

Q: What is short interest in stocks?

A: Short interest is the number of shares that have been sold short but not yet bought back, showing how many investors expect the stock to go down.

Q: Why is SMCI short interest important?

A: It helps investors understand market sentiment, potential price changes, and the risk of a short squeeze.

Q: How can I check SMCI short interest?

A: You can find SMCI short interest data on financial websites like Nasdaq, FINRA, and market research platforms.

Q: What does high short interest mean for SMCI?

A: High short interest can indicate bearish sentiment but also increase the chance of a short squeeze if the stock price rises.

Q: Can SMCI experience a short squeeze?

A: Yes, if many short sellers rush to buy shares to cover losses, SMCI’s stock price could rise quickly.

Q: What factors affect SMCI short interest?

A: Earnings reports, market trends, economic conditions, and institutional investor actions all influence short interest.

Q: How can traders use short interest data?

A: Traders can use it to spot potential price movements, manage risks, and find trading opportunities.