Investing in stocks can be both exciting and challenging, especially when dealing with emerging biotech companies like NVCT stock. Whether you are a seasoned investor or a beginner, understanding the fundamentals, market trends, and growth potential of NVCT stock is essential. This article provides a detailed analysis of NVCT stock, covering its company background, financial performance, recent developments, future outlook, and investment risks.

What is NVCT Stock?

NVCT stock represents shares of Nuvectis Pharma, Inc., a biotechnology company focused on developing innovative treatments for cancer. The company is committed to advancing clinical-stage oncology drugs that target unmet medical needs.

Key Facts About NVCT

- Company Name: Nuvectis Pharma, Inc.

- Stock Ticker: NVCT

- Industry: Biotechnology / Pharmaceutical

- Focus Area: Cancer treatment and drug development

- Stock Exchange: NASDAQ

- Market Capitalization: Subject to market fluctuations

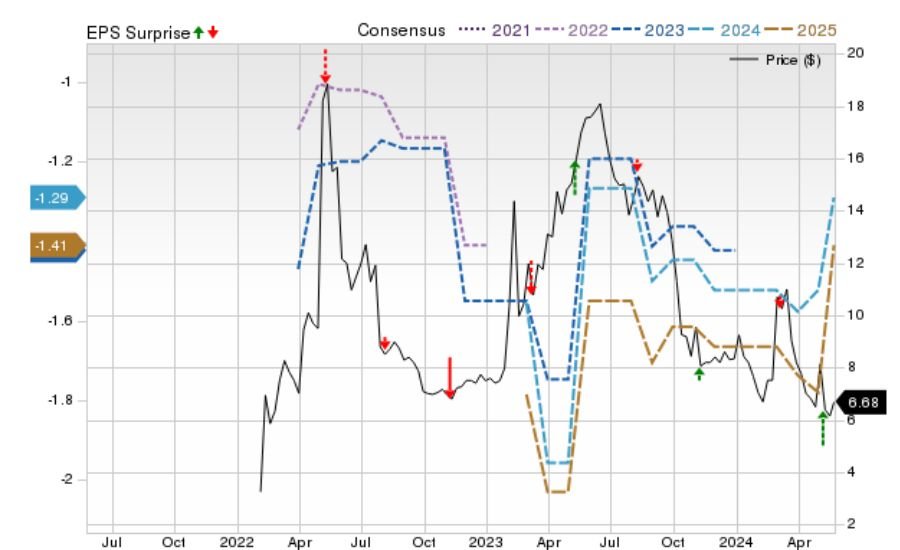

NVCT Stock Price History and Performance

Understanding the historical performance of NVCT stock is crucial for making informed investment decisions. The stock has experienced fluctuations influenced by various factors, including clinical trial results, regulatory approvals, and overall biotech market trends.

NVCT Stock Price Trends

- Initial Public Offering (IPO): NVCT went public at [specific IPO price] in [year].

- All-Time High: The stock reached its peak at [highest price] due to positive trial results.

- Recent Performance: In the last year, NVCT stock has traded within the range of [low price] to [high price].

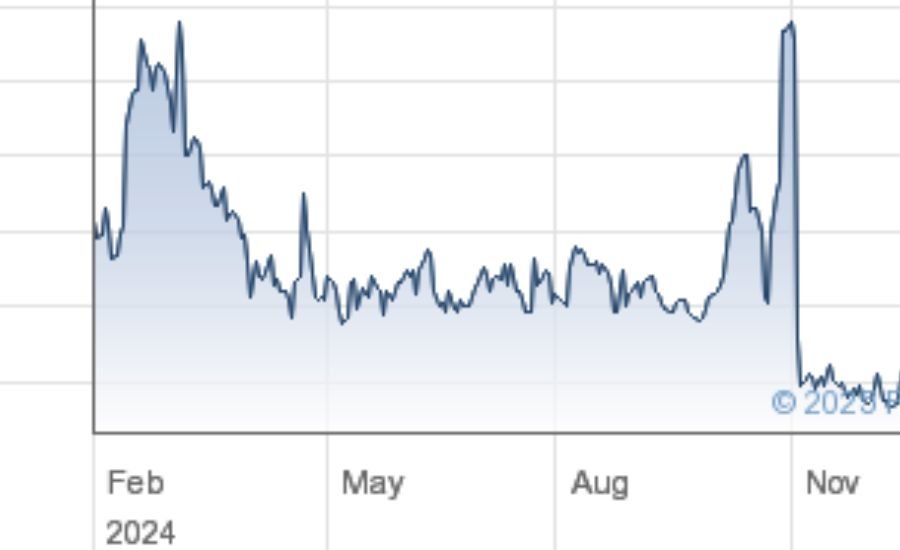

- Trading Volume: NVCT stock sees moderate trading activity, reflecting investor interest in biotech innovations.

Financial Analysis of NVCT Stock

A company’s financial health plays a critical role in stock valuation. Let’s analyze NVCT’s revenue, profitability, and key financial metrics.

Revenue and Profitability

- Revenue Growth: NVCT is in its early growth stages, with revenue primarily dependent on partnerships and funding.

- Net Losses: Like most biotech startups, NVCT reports net losses due to high research and development (R&D) expenses.

- Cash Reserves: The company maintains sufficient cash reserves to fund its operations for the next few years.

Key Financial Metrics

- Earnings Per Share (EPS): NVCT currently has a negative EPS due to ongoing R&D investments.

- Debt-to-Equity Ratio: The company has a manageable debt level, reducing financial risk.

- Burn Rate: NVCT’s spending rate on R&D determines how long its cash reserves will last.

Recent Developments Impacting NVCT Stock

Several recent developments have influenced NVCT stock’s performance, including clinical trial progress, regulatory approvals, and industry partnerships.

Clinical Trial Progress

NVCT is advancing its drug candidates through preclinical and clinical trials. The success or failure of these trials significantly impacts stock price movements.

Regulatory Approvals

The U.S. Food and Drug Administration (FDA) and other global regulatory bodies play a crucial role in NVCT’s success. Positive regulatory decisions can lead to stock price surges, while setbacks may cause declines.

Strategic Partnerships

Collaborations with large pharmaceutical companies provide financial support and expertise, enhancing NVCT’s credibility.

Read Next: Thebutterflylocs

Future Outlook for NVCT Stock

Investors are keen to know whether NVCT stock presents a buy, hold, or sell opportunity. Here’s a look at its future growth potential.

Growth Opportunities

- Expanding Pipeline: NVCT is working on multiple oncology drugs, which could boost its valuation.

- Mergers & Acquisitions: Potential acquisition by a larger pharma company could drive stock gains.

- Market Demand: The increasing need for innovative cancer treatments strengthens NVCT’s market position.

Potential Risks

- Regulatory Delays: FDA approval is uncertain, and delays can impact investor confidence.

- High Competition: NVCT faces competition from established biotech giants.

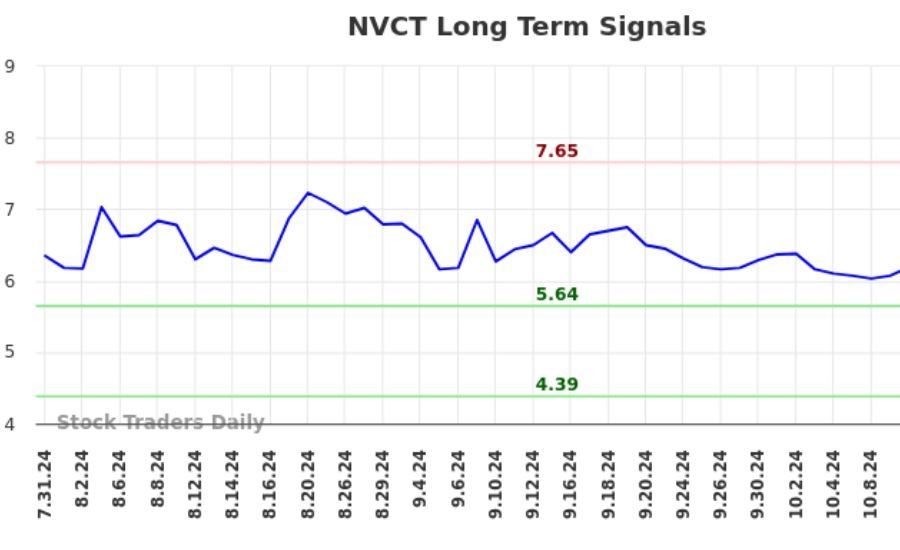

- Stock Volatility: Biotech stocks are inherently volatile due to speculative trading.

Investment Strategies for NVCT Stock

Investing in NVCT stock requires careful planning. Here are some strategies to consider:

Short-Term Trading

For traders looking for quick gains, NVCT’s stock price movements can present opportunities. Factors influencing short-term price changes include news releases and earnings reports.

Long-Term Investment

For investors with a high-risk tolerance, NVCT stock can be a valuable long-term investment, especially if its drug candidates receive regulatory approval and enter the market successfully.

Diversification

To mitigate risk, investors should diversify their portfolio by including NVCT stock along with other biotech and healthcare stocks.

Expert Opinions on NVCT Stock

Financial analysts and stock market experts have varying opinions on NVCT stock. Some believe its strong R&D pipeline makes it a promising investment, while others highlight the risks associated with biotech startups.

Bullish Sentiment

- Strong pipeline with promising drug candidates

- Potential for FDA approvals and commercialization

- Collaborations enhancing research capabilities

Bearish Sentiment

- High R&D expenses leading to continuous losses

- Market competition from larger pharmaceutical companies

- Uncertainty around clinical trial outcomes

Conclusion

NVCT stock presents both opportunities and risks for investors. As a biotech company focusing on innovative cancer treatments, NVCT has the potential for significant growth. However, regulatory challenges, financial constraints, and market competition remain key concerns.

Before investing, it is essential to conduct thorough research, analyze financials, and assess risk factors. Whether you are a short-term trader or a long-term investor, understanding the dynamics of NVCT stock can help you make informed investment decisions.

Don’t Miss Out: Pahwa-Effective-To-Do-Lists

FAQs

Q: What is NVCT stock?

A: NVCT stock represents shares of Nuvectis Pharma, Inc., a biotech company focusing on cancer treatment development.

Q: Is NVCT stock a good investment?

A: NVCT stock has potential, but it carries risks due to regulatory uncertainties and competition in the biotech sector.

Q: What factors affect NVCT stock price?

A: Key factors include clinical trial results, FDA approvals, market trends, and financial performance.

Q: Does NVCT stock pay dividends?

A: No, NVCT stock does not currently pay dividends as the company reinvests in research and development.

Q: What are the biggest risks of investing in NVCT stock?

A: Regulatory delays, competition, and high R&D expenses are the main risks.

Q: Where can I buy NVCT stock?

A: NVCT stock is listed on NASDAQ and can be bought through major stock trading platforms.

Q: What is the long-term potential of NVCT stock?

A: If NVCT successfully brings its cancer treatments to market, the stock could see significant growth.